American retirees will enter 2026 facing an expense that is growing faster than almost any other essential cost of post-work life: the Medicare Part B premium, which covers doctor visits, outpatient services, and hospital procedures outside of inpatient care. The increase, announced last week, was direct and heavy: US$ 202.90 per month, a jump of 9.7% compared to the previous year.

It is the first time the amount surpasses the symbolic US$ 200 mark. And, above all, it marks a historic moment: the Part B premium is 66% more expensive than just ten years ago. In a decade marked by wage stagnation, persistent inflation, and rapidly rising health care costs, this number is not just a statistic. It reaches directly into the pockets of more than 65 million Medicare beneficiaries.

And for many, this impact is even greater because the Part B premium is deducted directly from the Social Security check. The increase reduces, in a practical and immediate way, the cost-of-living adjustment (COLA) that retirees expected to compensate for inflation.

What is happening is not an isolated Medicare problem. It is a reflection of the pressures of a health care system whose costs rise faster than the economy. And for those living on fixed income, understanding what is behind this increase, and how to prepare for it, is crucial to keeping finances stable in the coming years.

The accelerated increase in Part B: a window into the health system’s cost crisis

The federal government sets Part B premiums to cover approximately 25% of the program’s projected costs. Thus, when expenses rise, premiums inevitably rise as well.

In 2026, two developments explain the increase:

- The growth of national health spending, which rose about 8% in 2024, according to federal data, and is expected to surpass Gross Domestic Product growth over the next 10 years.

- The structural shift in the way patients receive care, with more services and medications moving from hospitals to outpatient settings, which are precisely covered by Medicare Part B.

As Tricia Neuman, senior vice president of KFF, explains, “the Part B premium follows the real cost of health care, and that cost is rising faster than retirees’ income.”

The annual Part B deductible, meaning the amount the beneficiary pays before coverage begins, will also rise to US$ 283, an increase of more than 70% in the last decade.

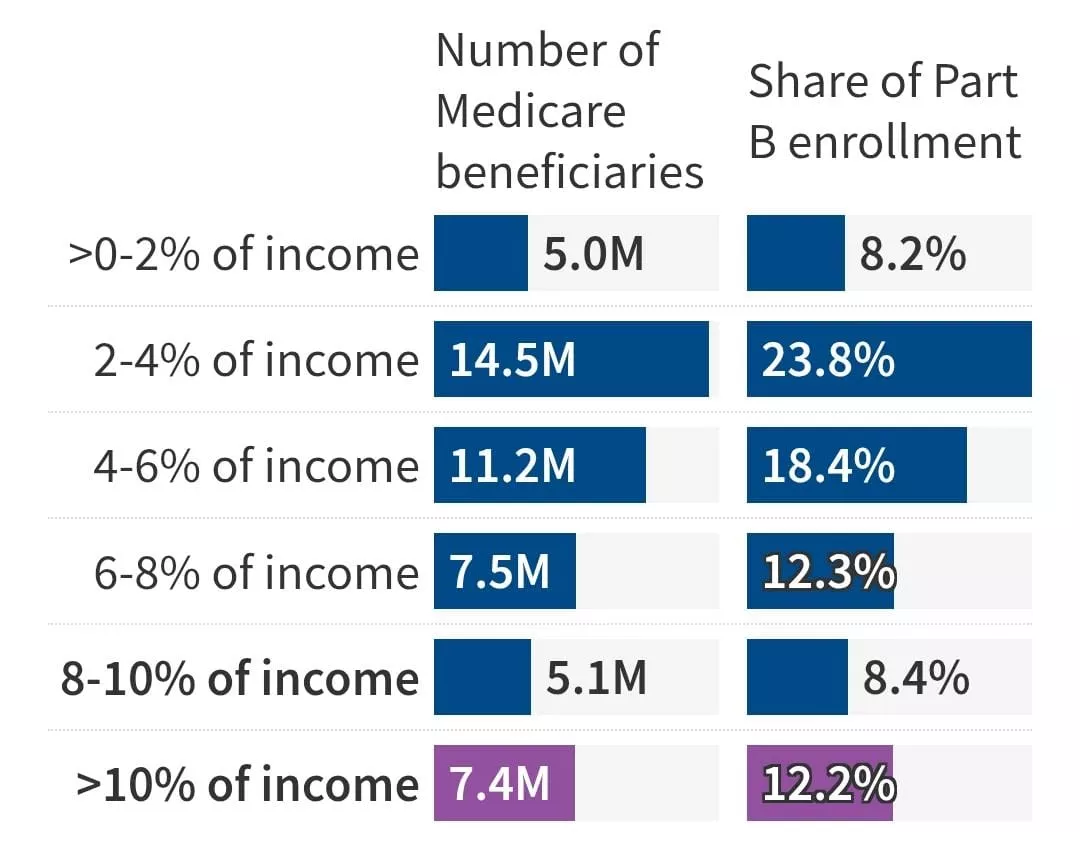

For millions of retirees, this progression is unsustainable. In 2024, more than 7 million beneficiaries spent at least 10% of their total annual income, according to KFF, solely on Part B premiums, not including doctor visits, medications, dental care, glasses, or long-term care.

When the Part B increase reduces Social Security’s COLA

The COLA, the annual cost-of-living adjustment, was 2.8% for 2026. At first glance, this seems like relief, but the Part B increase consumes a significant portion of this adjustment.

An average retiree receiving US$ 2,008 per month will see their effective COLA drop from 2.8% to 1.9% after the premium increase. For those receiving US$ 1,000 per month, the real COLA drops to 1%.

In practice, the increase cuts nearly in half the real adjustment of income, exactly when health expenses are rising faster.

Neuman summarizes the problem precisely: “Many people will not receive the cost-of-living adjustment they expected. The premium consumes a larger slice of a benefit that is already limited.”

Medicare Advantage: the hidden side of the cost

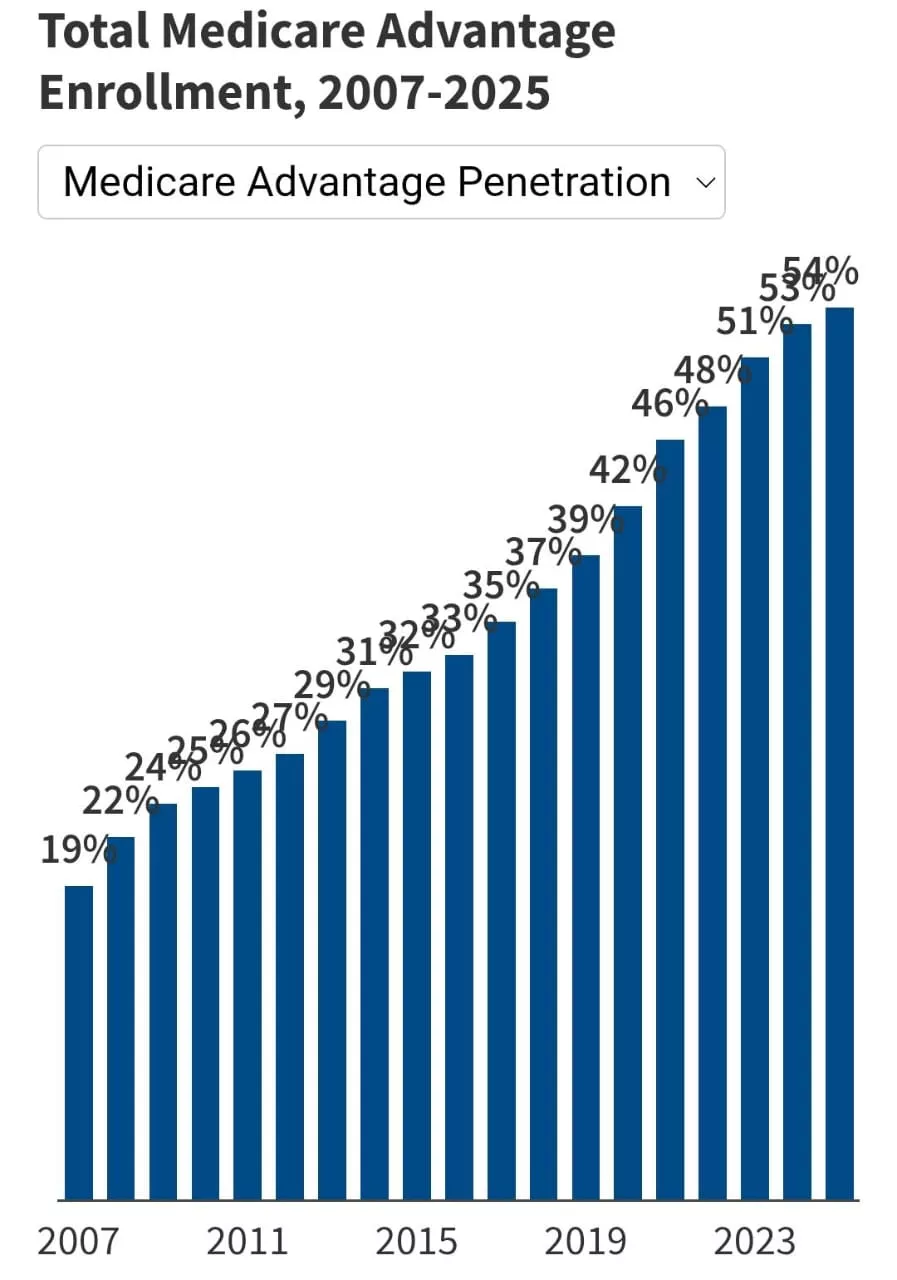

The rise of Medicare Advantage plans, now responsible for more than half of all enrollments, also influences the increase in Part B. Although these private plans offer appealing services such as annual spending limits and integrated drug coverage, they are expensive for the government.

Federal studies show that Medicare pays about US$ 80 billion more per year for Advantage beneficiaries than it would if those same people were in traditional Medicare.

This additional cost pressures both Part A and Part B, raising premiums paid by all beneficiaries, regardless of the plan.

These alternatives offered by private companies to traditional Medicare, administered by the government, usually reduce upfront costs by including prescription drug coverage. They also include personal spending limits (US$ 5,320 this year), without the Medigap policies that provide this protection in traditional Medicare. This has disadvantages, including provider networks and frequent bureaucratic complications with coverage approvals, known as prior authorizations.

Low-income seniors are the most affected

For retirees with fewer resources, every dollar counts, and the Part B increase has a direct impact on the monthly budget.

In 2024, more than 10% of enrollees spent a substantial portion of their income solely on the premium. Many also face:

- rising energy expenses,

- home insurance surging in price,

- higher food costs,

- and uncovered medical expenses such as dental and hearing care.

Despite these challenges, only 60% of people eligible are enrolled in the Medicare Savings Programs, which cover premiums and reduce cost-sharing. Largely, this happens because many do not know about the benefit, or because the application process is bureaucratic and confusing.

For low-income seniors, these programs can represent hundreds of dollars saved per month.

IRMAA: the silent increase for high-income retirees

Seniors with higher incomes will face another pressure factor: IRMAA (Income-Related Monthly Adjustment Amount), which adds significant surcharges to Part B and Part D premiums.

In 2026, IRMAA begins to be charged for:

- single taxpayers with income above US$ 109,000;

- married couples with joint income above US$ 218,000.

The first surcharge adds US$ 81.20 to the monthly premium. In the higher brackets, the amount can easily exceed US$ 500 per month.

But there is an important detail: IRMAA is based on income reported two years earlier, which means that recent retirees may pay unnecessary surcharges unless they request a formal reassessment.

As physician and financial planner Carolyn McClanahan explains, “if you used to earn US$ 250,000 and now earn less than US$ 100,000, you can save a lot just by filling out a two-page form.”

To review IRMAA, beneficiaries must use Form SSA-44, which covers life events such as retirement, spouse death, or loss of income.

Total health care costs in retirement: a reality impossible to ignore

Predicting these costs is not simple, but ignoring them can be disastrous.

Fidelity Investments, for example, estimates that a 65-year-old retiree with average life expectancy will spend about US$ 172,500 throughout retirement solely on health care expenses. For couples, this number surpasses US$ 300,000.

Still, McClanahan warns that long-term projections have limitations. For her, the ideal approach is to view health care costs as a variable annual item, reviewed regularly as medical issues arise or change.

This includes:

- Medicare premiums,

- medical treatments,

- medications,

- non-covered services (vision, hearing, dental),

- and potential long-term care expenses.

How to prepare for the Part B increase in 2026

The nearly 10% increase is not just another annual adjustment. It signals a permanent trend: Medicare costs are rising faster than Social Security benefits. For retirees and families, this requires proactive planning.

Here are three practical actions recommended by experts:

The first is to carefully review the annual budget, treating health care costs as a dynamic category. Spending more in one year may mean adjustments in travel, food, or leisure; maintaining specific financial reserves for medical expenses is essential, especially for those facing chronic illnesses.

The second is to immediately check eligibility for assistance programs, especially the Medicare Savings Programs. Many retirees fail to save hundreds of dollars because they mistakenly believe they do not qualify.

The third is to monitor changes in IRMAA and request reassessment when there is a drop in income. For many new retirees, this represents immediate and significant savings.

What is at stake in the coming years

The Part B increase is not just about 2026. It represents the tip of a larger iceberg: the rising cost of health care in a country that is aging rapidly and facing economic pressure in all directions.

The current trend suggests that Medicare premiums will continue rising, that COLA will continue to be consumed by medical expenses, and that retirees, especially low-income ones, will face increasingly difficult financial decisions.

Still, information and planning can make a tangible difference. Talking to specialists, reviewing coverage options, understanding underutilized benefits, and adjusting expectations can transform a daunting scenario into an action plan.

Medicare has always been a pillar of American retirement. But like any pillar, it needs to be reinforced with strategy, care, and ongoing attention.

In times of accelerated medical inflation, this reinforcement can be the difference between stability and vulnerability, between living retirement with security or with constant uncertainty.