The resumption of student loan payments in the United States has revealed a silent wound that had remained partially hidden in the accounts of many young adults.

For Generation Z, those born approximately between 1997 and 2012, starting adulthood with a damaged credit history has become as concerning as student debt itself.

The End of the Pause and the Beginning of the Problem

During the pandemic, payments on many student loans were suspended, a measure that served as temporary relief. When the moratorium ended, however, tens of thousands of borrowers began facing not only the challenge of repayment but also the risk of having their delinquencies reported to credit bureaus. According to FICO, around six million consumers had student loan delinquencies recorded between February and April, and the average score of those borrowers dropped from 617 to 548 during that period.

For Generation Z, the effect was even more severe. The average score for this age group dropped to 676 in April, while the national average remained around 715. About 14% of young adults experienced declines of 50 points or more, the highest percentage ever recorded for this age group.

Why It Matters

A credit score acts as a financial passport: it can determine whether someone qualifies for a credit card, a mortgage, or even a rental agreement. When the score drops, loan costs rise and opportunities narrow.

For many young people still building their independence, the combination of student debt, unstable income, and a limited credit history can create a cycle of delinquency that’s difficult to break.

Understanding the Factors

The formula that makes up a FICO score is well known: payment history (35%), amounts owed or credit utilization (30%), length of credit history (15%), types of credit (10%), and new credit inquiries (10%). In general, any missed loan payment negatively affects the first and most important component. In the case of student loans, the impact is often even greater because a single delinquency can affect multiple accounts at once.

“If you don’t make any payments, you’re in default on all of them,” warned a former FICO executive.

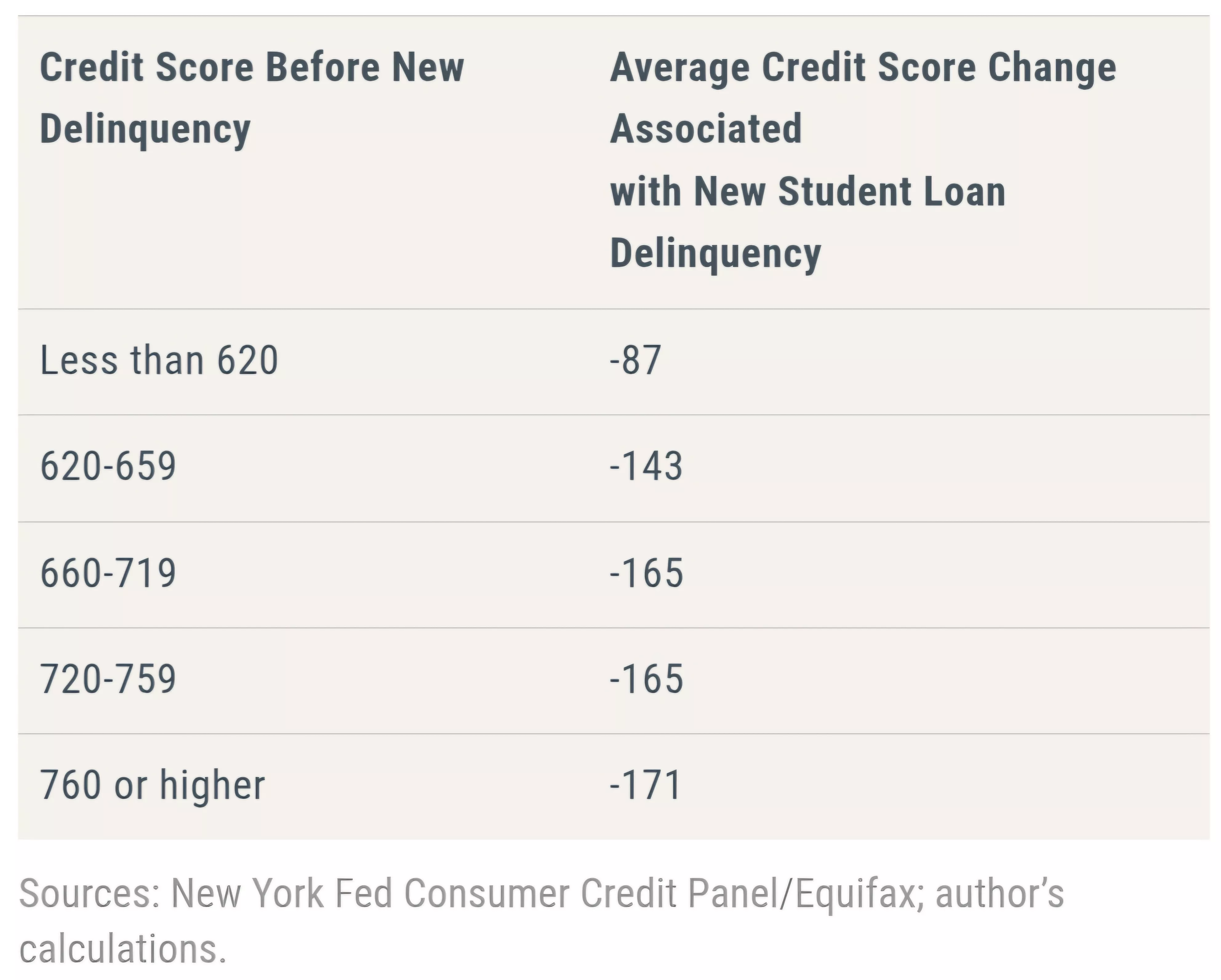

According to the Federal Reserve Bank of New York, a single missed payment on a student loan can lower a credit score by more than 150 points, depending on the borrower’s profile. That means a young adult with a 700 score could see it fall to around 550.

When combined with other unfavorable factors, such as low income or lack of credit history, the result can be devastating for one’s financial trajectory.

Table of Impacts and Score Levels

| Student Loan Status | Typical Score Range Before | Score Range After Delinquency* |

| On-time payments | 650–720 | Remains stable |

| Moderate delinquency reported | 620–680 | Drops to 550–620 |

| Default recorded (90+ days) | 600–670 | Possible drop to < 580 |

*Estimated values based on analysis of FICO and New York Fed reports.

| Score Range | Rating | Description |

| < 580 | Poor | This score is well below the average of U.S. consumers and indicates to lenders that the borrower represents a high risk of default. |

| 580–669 | Fair | This score is below the national average, but many lenders still approve loans within this range, typically at higher interest rates. |

| 670–739 | Good | This score is close to or slightly above the average for U.S. consumers and is generally considered acceptable by most financial institutions. |

| 740–799 | Very Good | This range indicates that the borrower is reliable and poses a low risk of default. It usually grants better credit terms and lower interest rates. |

| ≥ 800 | Exceptional | This score is well above average and shows lenders that the borrower represents minimal risk, often leading to the best rates and faster approvals. |

The minimum score considered to reflect “good credit” is 670

Why Young People Are More Vulnerable

Generation Z entered adulthood in an unusual environment: the job market was disrupted by instability, inflation eroded incomes, and many began relying on debit cards or “Buy Now, Pay Later” (BNPL) programs instead of traditional credit, which does not contribute to building a credit history.

In addition, the Credit Card Act of 2009 tightened requirements for those under 21, reducing access to student credit cards and, consequently, the opportunity to build credit early.

Adding to all of this, the reporting of student loan payment data to credit bureaus resumed only at the end of 2024, leading to a surge in accumulated delinquency reports.

How to Respond

For young adults who find themselves in this situation, acting quickly is essential. Some strategies recommended by experts include:

- Contact your loan servicer to explore income-driven repayment plans or deferment options.Avoid opening multiple new credit accounts, since each new application can negatively impact your score.

- Use alternative credit-building tools, such as rent or utility payments reported to credit bureaus, which can help rebuild credit history.

- Automate minimum payments to prevent fatal oversights that could result in late payment records.

- Monitor your credit report for free once a year from each bureau (Equifax, Experian, TransUnion) at www.annualcreditreport.com.

Rebuilding Is Possible

Although late payments can remain on your report for about seven years, your score can start to improve after just 12 to 24 months of consistent, on-time payments.

“You’d be surprised how quickly scores can recover,” says a credit consultant. Still, the journey requires discipline and time.

The Institutional Challenge

There’s also a broader issue: the U.S. credit system was not designed for a scenario in which young adults begin life burdened with debt, unstable income, and limited job opportunities.

While banks continue to develop premium cards for high-income consumers, entry-level products are becoming more restrictive, creating a market gap that isn’t always filled by accessible alternatives.

Final Reflection

For Generation Z, falling behind on student loan payments isn’t just a note on a credit report. It’s an obstacle that can delay dreams, restrict choices, and increase the cost of living for decades. At the same time, it’s a wake-up call for policy, financial products, and education to adapt to a new reality.

The good news is that taking action today matters. Every on-time payment, every controlled balance, and every consciously used credit product is a brick laid in rebuilding financial trust. Ultimately, building credit isn’t just about numbers, it’s about opening doors to the future.